Oftentimes, people borrow for a number of reasons, it could be due to an emergency, as a result of a new project or to finance a business. This same thing applies to countries that are in need of money to get out of a difficult situation, undertake a project or solve certain national issues. So when a country borrows from another country to solve some national issues, automatically that country becomes indebted to the other country that it has taken a loan from. Nigeria is not left out in this issue of borrowing.

Although debt is a neutral notion, it can turn negative when handled incorrectly. The debtor’s sense of obligation to the lender and the group for whom the loan is being taken is a crucial component of debt. Due to this sense of accountability, the borrowed money must be put into projects that promise a profit.

Typically, nations retain a record of their errors and work to avoid them. Nigeria, on the other hand, seems to favor revisiting its biggest errors and disasters.

From history, facts and figures have it that all Nigeria’s heads of state borrowed funds to service National debts. When Obasanjo was elected president in 1999, he negotiated a $19 billion partial write-off of Nigeria’s foreign debt, giving the country a somewhat unblemished financial position by the time he left office in 2007. This debt profile gradually increased, and then 2015 came.

The government borrow trillions of naira, and ironically still pay trillions annually to subsidize both gasoline and an unjustifiably high foreign exchange rate that harms the country’s economy. The government’s economic policies have also succeeded in making it difficult for local enterprises to operate while discouraging foreign investment in the nation. The government must borrow more and more money to pay for its expenses as FDI inflows continue to decline and capital flight increases.

While the government is becoming more unfriendly and parasitic to the productive sectors of the country that it should help to achieve adequate economic growth and development, poverty and insecurity are on the rise in part as a result of government actions. The nation’s infrastructure is in a terrible state, and several interstate routes are currently impassable or irreparably damaged by kidnappers and other robbers.

The same combination of callousness, haughtiness, and appalling incompetence that propelled Nigeria to its current status as the poster child for amazing mediocrity is once again at work.

We have the option of accepting that or handling it in a way that ensures it never rears its ugly head again.

External Debt Sources

Nigeria has incurred a variety of debt commitments from foreign sources, some of which are listed here:

- Paris Club of Creditors

- London Club of Creditors

- Multilateral Creditors

- Promissory Note Creditors,

- Bilateral and private Sector Creditors.

Numerous reasons contributed to Nigeria’s external debt ballooning to US$29 billion by the end of 2000. The major factors include rapid growth in public spending, particularly on capital projects, applying for a loan from the global community at non-concessional interest rates, a decline in oil earnings beginning in the late 1970s, and reliance on imports, all of which contributed to the growth of trade arrears. By 1986, short and medium-term loans accounted for around 85.0 percent of overall debt. The aforementioned changes led to the bundling of debt servicing, thus aggravating the financial crisis. Furthermore, changes in interest rates have an impact on the amount of the foreign debt stock.

Nigeria’s Public Debt: Stylized Facts and Trends

The national debt has been a supporting pillow on which Nigeria has rested her head after the centerpiece of survival on crude oil. Nigeria’s debt profile may be traced back to decades before independence, although it remained tiny or inconsequential until 1978, owing mostly to the influence of the 1972-73 oil boom, which reduced Nigeria’s debt stock. Following the 1977/1978 economic slump, Nigeria obtained the first $1 billion loan from the international capital market to finance infrastructure projects. This action increased the country’s debt stock to $5.09 billion.

As our focus on this article is on Nigeria’s debt history between 2000 and 2024, we wouldn’t want to bore you with a lot of details about Nigeria’s debt history between 1970’s and late 1990’s.

We have had three Presidents during the course of 2000 – 2022 namely;

- GENERAL OLUSEGUN AREMU OKIKIOLA MATTHEW OBASANJO (RTD) MAY 29, 1999 – 29 MAY, 2007

- UMARU MUSA YAR’ADUA 29 MAY, 2007 – 5 MAY, 2010

- GOODLUCK EBELE JONATHAN 6 MAY, 2010 – 29 MAY, 2015

- MUHAMMADU BUHARI 29 MAY, 2015 – DATE

The idea of mentioning them in this article is to provide you with a clear picture as to which President and under which administration was a certain amount of borrowing made.

President Obasanjo was forced to negotiate a broker of the Paris loan to $19 billion at the conclusion of the 2005 fiscal year. Nigeria’s debt profile has increased dramatically in recent years, raising the question of where the monies are being funneled.

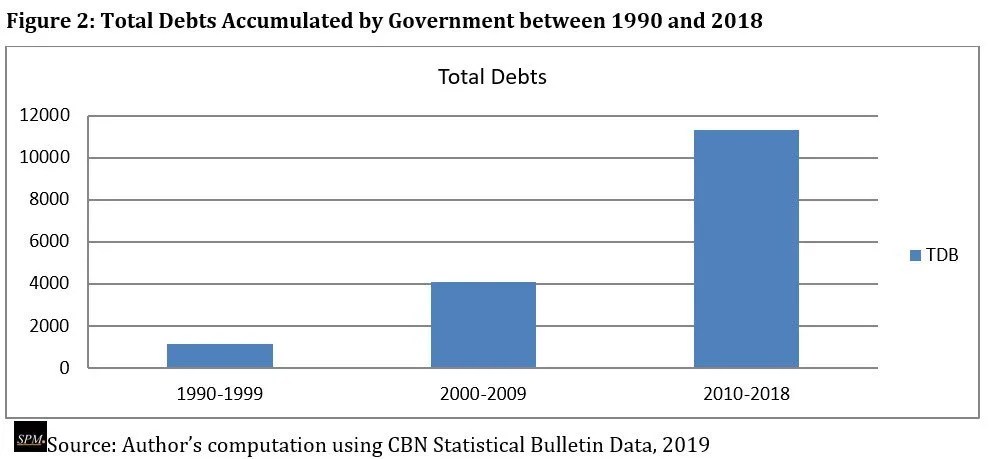

Between 2010 and 2018, Nigeria’s external debt surpassed $16.7 trillion, a 128 percent rise over the previous level and a larger growth than the debt stock before 2010. This suggests that Nigeria has borrowed more in recent years than in prior years. As of the end of January 2019, the Central Bank of Nigeria cautioned the country that if the borrowing behavior continued, the government would be forced to return to pre-2005 Paris Club levels. Nigeria’s debt stock was reported to be 26.2 trillion as of September 2019, with external debt accounting for 31.55 percent of total debt and domestic debt accounting for 68.45 percent.

According to the aforementioned pattern, there has been a steady and aggressive rise in the country’s debt profile with no concurrent and consistent improvement in economic development and the standard of life of the economy’s population (see Figure 1). As of today, CNN estimates that an estimated 87 million Nigerians, or over half of the country’s population, are still living in extreme poverty, based on the international poverty line of $1.95, which corresponds to the World Bank’s 53.6 percent poverty rate in 2009. So, why should we continue to incur debt if it does not result in growth and development?

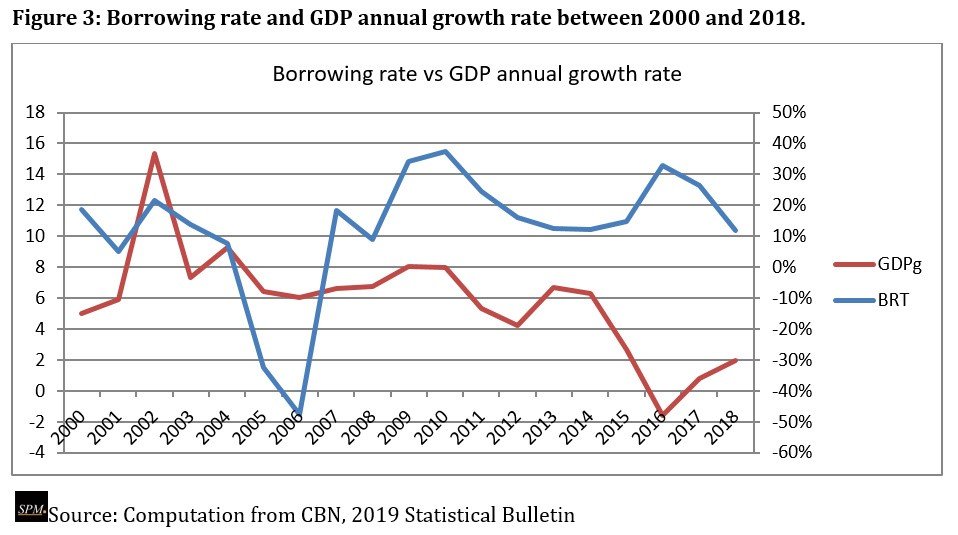

Also, we can see a graphical representation of Nigerians borrowing rate as against its growth rate from 2000 to 2028. We can see that the rate of borrowing decreased in 2006 which was around the time Nigeria exited the London and Paris club debt.

Nigeria’s governmental debt has been rising. Despite achieving debt relief under the Olusegun Obasanjo administration, subsequent administrations have remained on a borrowing binge, with the federal government’s component of the public debt increasing 658 percent in the previous 21 years to N26.9 trillion.

This has sparked worries among Nigerians about the country’s debt sustainability in the face of declining earnings to pay debt obligations to creditors. We would be analyzing the debt profile of the country under the administration of the four Presidents who have served Nigeria between 2000 and 2020.

NIGERIA’S DEBT STATUS UNDER OLUSEGUN OBASANJO

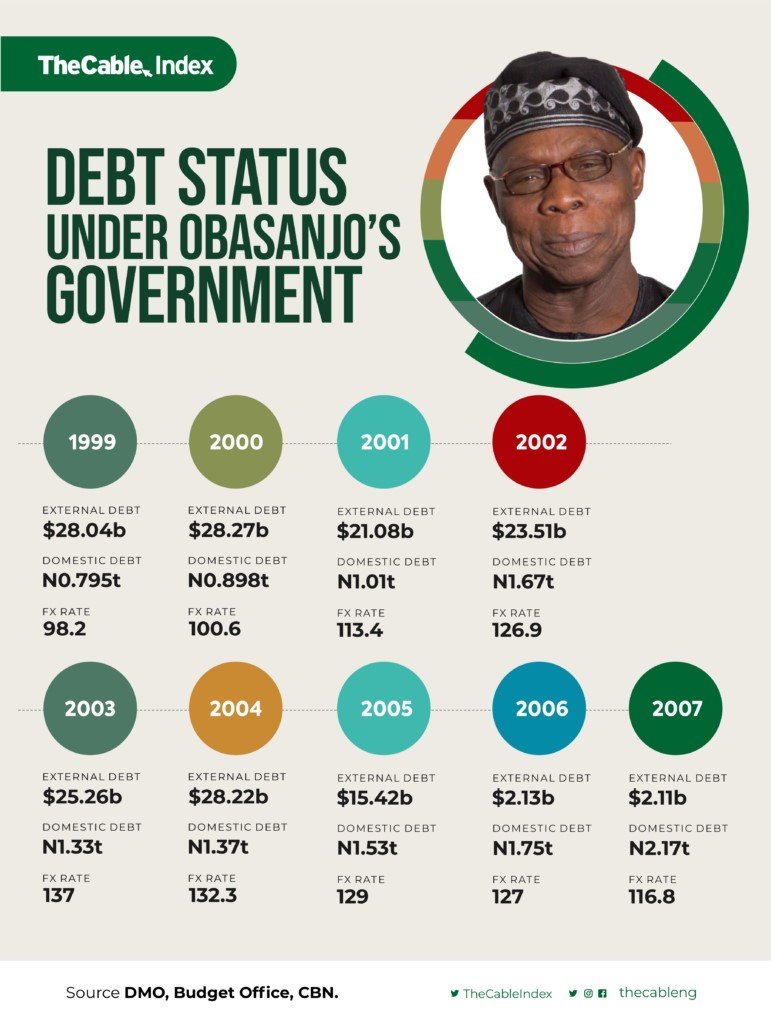

Former President Olusegun Obasanjo lowered the federal government’s debt from N3.55 trillion in 1999 to N2.42 trillion by the end of 2007 as you can see from the graph above.

Obasanjo’s 8-year tenure resulted in a 31.8 percent decrease in FG’s local and international debt levels. During his term, the country’s currency value was moved from N98.02 to N116.8 per dollar.

According to the data, external debt declined from $28.04 billion in 1999 to $2.11 in 2007. During the same time span, however, the domestic component climbed from N798 billion to N2.17 trillion.

The massive drop in foreign debt was the consequence of a significant reduction following the payment of outstanding payments to the London Clubs of Creditors within the first four months of 2007.

BORROWINGS OF YAR’ADUA/JONATHAN

Between 2007 and 2011, the federal government’s internal debt increased from N2.17 trillion to N5.62 trillion under the leadership of Umar Musa Yar’Adua/Goodluck Jonathan. During the same time period, the foreign component of the debt climbed from $2.11 billion to $3.5 billion.

The country’s currency rate likewise shifted from N116.8 to N156.7 per dollar.

In four years, the total debt profile climbed by 155 percent, from N2.42 trillion to N6.17 trillion.

After Yar’Adua’s death in May 2010, Jonathan continued the administration from May 2010 to May 2011. During this time, the federal government’s debt increased from N4.94 trillion to N6.17 trillion. In one year, this is a 24.9 percent growth.

JONATHAN’S ADMINISTRATION’S DEBT PROFILE

The federal government owed N6.17 trillion at the start of former President Goodluck Jonathan’s term in 2011.

The debt data revealed that domestic debt was N5.62 trillion, while foreign debt was $3.5 billion (approximately N548.65 billion at the exchange rate of N156.7/$1).

The international debt component had reached $7.3 billion by the end of 2015, while local debt had climbed by N8.4 trillion. The currency rate in the nation was similarly N197/$1.

Furthermore, the federal government portion of the total public debt climbed from N6.17 trillion in 2011 to N9.8 trillion in 2015, a 58.8 percent rise.

HOW MUCH DID BUHARI BORROW IN 6 YEARS?

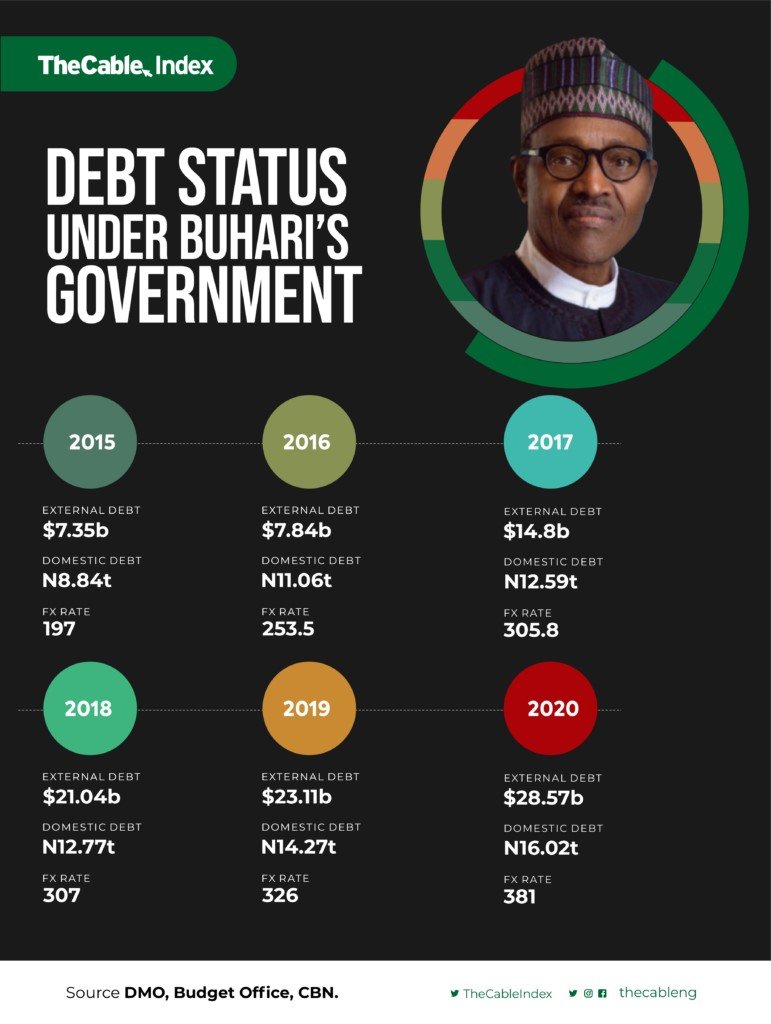

According to the Budget Office’s 2015 medium-term spending framework and fiscal policy paper, the Buhari government amassed N7.63 trillion in domestic debt from June 2015 to December 2020.

President Buhari boosted foreign borrowings from $7.3 billion in 2015 to $28.57 billion by December 2020. This indicates that the president added $21.27 billion to the country’s debt portfolio through foreign borrowing.

The country’s currency rate increased from N197 per dollar in 2015 to N381 by December 2020.

In the previous six years of the Buhari administration, external debt soared by 291.37 percent whereas domestic debt increased by 86.31 percent, according to consolidated debt analysis.

Using the N381 exchange rate, the Buhari-led government’s total debt as of March 2021 was N17.06 trillion. This reflects a 173.2 percent rise since his election as president in 2015 and he seems to be borrowing more and more with each passing day.

INCREASING NATIONAL DEBT WORRY

While borrowing is necessary to boost the economy, openness and a long-term repayment plan are critical. The Nigerian government takes a loan in the most inefficient and outmoded method conceivable.” As a result, the administration faces a reaction. Because Nigeria’s debts are not connected to any assets, we enter the Treasury bill market and borrow at whatever rate anyone wants to give us.

A host of other countries borrow more than Nigeria does and have no trouble repaying it. They borrow wisely and effectively so that their loans pay for themselves. The Federal Government may save money by converting all of its loans to asset-linked debts.

This entails making the borrowing arrangement as if it were an investment. There should be an underlying asset that borrowers may utilize to collect the principle plus the profit they lent the government.

The government is borrowing more money, spending more money, and generating less money. For comparison, the government budgeted N5.37 trillion in income for 2020 but only received N3.42 trillion.

Stress models confirm the public debt’s susceptibility to a low economic expansion primary deficit scenario. The interest-to-revenue ratio is more sensitive to a real interest rate shock, although it is nevertheless sustainable.

Market analysts at United Capital have recently raised alarm about the country’s mounting debt sustainability risk. “Historically, the government has justified its expanding debt profile by maintaining a debt-to-GDP ratio about less than 30.0 percent,” the research group stated.

Nevertheless, we maintain our position that the FG’s debt service cost as a percentage of income, more appropriately represents the country’s debt sustainability situation.

With a total national debt of N33.1 trillion ($87.24 billion), every Nigerian owes N165, 500 to both domestic and international institutions.

The above are some of the worries about Nigeria’s national debt profile.

To have the file on your devices, you can click the PDF file below to download and save on your system for reference purposes or personal use.

Download ⇒ Nigeria’s National debt profile – PDF File

In conclusion, the DMO (Debt Management office), IMF (International Monetary Fund), IBRD (International Bank for Reconstruction and Development) have all warned about the current crisis Nigeria is facing and the impending damage that it will cause with our ever increasing national debt. It is now left for the policy makers and the government to do something about this before we would be passing billions and trillions of debt to our unborn children with our current level of borrowing.