Foreign reserves are liquid assets that are held by the central bank or other monetary authority of a country, in order to undertake monetary policies that have an influence on the country’s currency exchange rate and to ensure that the country can pay for its imports. The Democratic Republic of Congo (DR Congo), which is located in Central Africa, has amassed the greatest amount of foreign currency reserves since it gained independence in the year 1960.

Basically, in our contemporary world, large amounts of foreign reserves are a symbol of a country’s strength because they demonstrate that the nation’s currency is supported by a strong economic policies. As a result, it inspires trust in the nation among members of the international community, whereas a low level of foreign reserves suggests the reverse.

The liquid assets that make up a nation’s foreign exchange reserves are broken down as follows: market-valued securities; currencies; deposits held with other central banks, banknotes, gold, deposits, bonds, treasury bills, and other foreign government securities.

Having known what a country’s foreign exchange means, this article will be limited to Nigeria, the giant of Africa. The big question is, what has been the outlook of Nigeria’s foreign exchange reserves since the year 1999 till present?

THE PROFILE OF NIGERIA’S FOREIGN EXCHANGE RESERVES

PHOTO CREDIT: THE GLOBAL ECONOMY

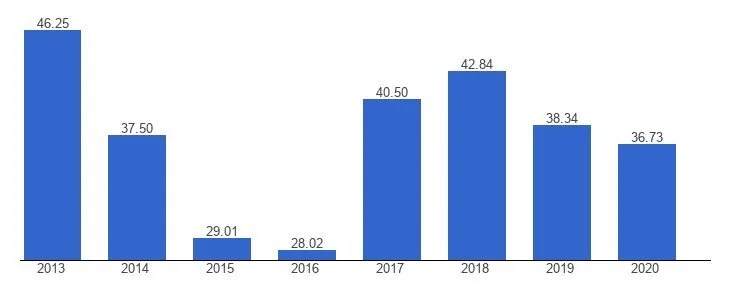

In recent years, Nigeria’s foreign exchange reserves have increased to enormous levels, and there is still room for further expansion. At the time when political affairs were transferred from the military to the civilian administration of President Olusegun Obasanjo in May 1999, Nigeria’s total external reserve amounted to $4.98 billion. In 2008, it hit an all-time high of $ 58 billion, and then in October of 2016, it dropped to $28.02 billion.

Obviously, the indications of the country’s foreign exchange reserves have remained healthy over the past years. In the year 2000, the reserves were $9.9 billion, which was equivalent to 20.4% of the Gross Domestic Product (GDP). In 2001, they increased to $10.4 billion, which was equivalent to 16.8% of the GDP. In spite of a discernible rise in GDP, the ratio of foreign reserves to GDP fell to 9.9 and 9.2 percent, respectively.

During the period of 2006-2010, the ratio of foreign reserves to GDP did not adhere to any particular pattern at any point. The proportion of stronger foreign reserves to GDP climbed from 9.2 percent to 9.4 percent in the year 2004. This was higher than the ten-year average by a significant margin.

Immediately after the year 2004, despite the fact that GDP kept expanding, the share of foreign reserves decreased between 20.9 percent and 20.1 percent in 2005 and 2006, respectively. As a result, there was a general increase of 26.6 percent in Gross Domestic Product (GDP), as well as foreign reserves between the years 2007 and 2009.

In 2010, the country’s foreign reserves fell to $32.5 billion, which resulted in a decrease of $17.6 billion in relation to GDP. However, the Governor of the Central Bank of Nigeria (CBN) attributed the depletion to the outflow of reserves in order to finance special power projects, replace oil wells that had been bombed; production centers that had been attacked during the Niger Delta crisis, and support the naira during a time when it was under attack by speculative investors.

As a result of the persistent rise in the price of crude oil, other OPEC (Organization of Petroleum Exporting Countries) nations have seen an increase in the amount of money they have in their foreign reserves. The situation in Nigeria has been unique, particularly between the years 2006 and 2010. Despite an increase in the price of oil, the recent decrease in the country’s foreign reserves has brought into doubt the efficacy of the government’s management of the economy.

In recent times, Godwin Emefiele, the Governor of the Central Bank of Nigeria (CBN), made an announcement that the country’s foreign reserves had hit a new high of $38.2 billion, breaking a record that had stood for 39 months.

In the year 2020, Nigeria had a total of 36,729 million US dollars in the form of international reserves. In spite of the fact that they have been very volatile over the course of the past few years, Nigeria’s overseas reserves have, on average, been growing since 1971. The value of the currency was devalued twice in 2020 by the Central Bank.

Subsequently, after reaching a high of $34.80 billion in the first quarter of 2021, the reserves fell to a low of $33.3 billion in the second quarter of the year before climbing to a high of $34.97 billion in the third quarter of that same year. At the end of this quarter, it was anticipated to reach approximately $41.82 billion in value.

The naira has been under pressure as a result of the increasing demand for US dollars, which has resulted to the low turnout of foreign investors in the country.

The depreciation of the Nigerian official exchange rate was probably done in an effort to harmonize the different exchange rates that were being used for the currency.

Razia Khan, an economist with Standard Chartered Bank, made the observation that the foreign exchange component would have been reduced each time a distribution was made from the excess crude account (ECA) to the three tiers of government (federal, state, and local). This leads one to believe that excessive spending, and not the stability of the naira, is causing Nigeria’s depletion of its foreign exchange reserves.

SOURCES OF NIGERIA’S FOREIGN EXCHANGE RESERVES

The majority of Nigeria’s foreign exchange reserves come from the profits made from the country’s production and sales of crude oil.

About two million barrels of crude oil are produced every day from oil producing states in joint ventures between Nigeria and a number of multinational oil firms, the most notable of which are Shell, Mobil, and Chevron. It is worthy to note that Nigeria used part of the reserves to pay off her external debt.

In addition to its oil reserves, Nigeria also possesses other natural resources like natural gas, tin, niobium, iron ore, coal, limestone, lead, zinc, and arable land. It is possible for nations to acquire foreign currencies through the export of goods and the attraction of investment from other nations. They put some of these currencies to use in the process of making import purchases as well as investments in the economies of other nations. The remainder is kept in reserves, and there is a possibility that some of those reserves will be turned into gold.

The Central Bank of Nigeria, often known as the CBN, is in charge of the country’s foreign exchange reserves. It is responsible for making periodic announcements regarding the overall level of reserves. Nigeria’s Foreign Exchange Reserves data is updated weekly, available from Jan 1960 to May 2022, even though this study is limited to the years 1999 to 2021.

According to Jonathan Aremu, an economics professor at the University of Nigeria and a former assistant director at the Central Bank of Nigeria, “If you do not want a fall in your foreign reserves, then increase your exports.”

Aremu noted that Nigeria’s foreign reserves would continue to dwindle if a greater amount of dollars were spent to pay for imports. He also explained that in order to maintain its economy, Nigeria needed to either reduce the amount of money it spends on imports or start exerting more effort to acquire foreign currency.

According to reports, Nigeria is a nation that is dependent on imports. The value of Nigeria’s total imports was valued at $20.843 trillion, while the value of the country’s exports was $18.907.79 trillion in 2021. However, more than 70 percent of total exports consist of crude, which was then refined and re-imported after being delivered overseas in the first place. Sad right?

At present, production quota is being negatively impacted as a result of oil theft that is plaguing Nigeria in the Niger Delta region of the country. The government is making serious efforts to combat vandalism committed against pipelines, which has led to low production, and it is anticipated to have a detrimental impact on the country’s foreign exchange reserves.

As at [July], 2024 Nigeria’s foreign reserve is $38.483bn. This is a steady decline in Nigeria’s foreign reserve hence the free fall of the Naira to the US Dollar.

FOREIGN EXCHANGE RESERVES AND HOW THEY WORK

The foreign exchange reserves of a country are the various forms of foreign currency that are held by the central bank. The nation’s foreign exchange reserves are the funds it has stashed away in case of an unexpected crisis, such as a sharp drop in the value of its currency.

There are different reasons why financial institutions keep reserves. The most significant reason is to maintain control over the value of their respective currencies. Banknotes, deposits, bonds, treasury bills, and other types of government assets can all count as parts of a country’s foreign exchange reserves.

Also, countries preserve foreign currency reserves in order to maintain a stable value for their currency, keep export prices at a competitive level, keep themselves liquid in the event of a crisis, and provide investors with confidence. Additionally, they require reserves in order to pay off their external loans, be able to afford the capital to fund various sectors of the economy, and profit from diversified portfolios.

The majority of a country’s reserves are often denominated in US dollars because this is the currency that is used internationally. The amount of foreign currency reserves held in dollars by China is the greatest of any country in the world.

WHAT HAPPENS IF A COUNTRY’S FOREIGN EXCHANGE RESERVES ARE DEPLETED?

There is every possibility for a country’s economy to suffer irreparable damage in the event that its foreign exchange reserves are exhausted. Even if a country has huge gold reserves or Natural resource reserves, these kinds of commodities do not have the same level of liquidity as a nation’s foreign exchange reserves. If a government is unable to spend money and acquire things in a timely manner, this could shatter people’s trust in the national currency and destabilize markets more broadly.

A crisis involving the balance of payments could be triggered by a number of different events. The central bank has several options available to it, one of which is to borrow larger quantities of the reserve currency from the central bank of the reserve country, the government of the reserve country, or an international organization such as the International Monetary Fund (IMF).

The purpose of the International Monetary Fund (IMF) is to assist nations who are experiencing difficulties with their balance of payments. When a nation’s currency reserves are getting low, it is possible for that nation to borrow reserve currency from the International Monetary Fund (IMF). The government would be able to repay the loans to the IMF in the near future, as long as the country’s balance of payments deficit, which caused the depletion of reserves, goes back to the balance of payments surplus.

It is essential to point out that the government’s carelessness with regard to the accumulation of international reserves is unacceptable. Due to the need to withstand the effects of financial shocks brought upon us by the international economy, it is paramount for Nigeria to build up its reserve funds in order to prepare for the possibility of a new global financial crisis.

Just like in the year 2020, Nigeria’s foreign reserves fell drastically due to the effects of the Covid19 pandemic that ravaged the global economy.

Also, empirical findings suggest that Nigeria’s foreign exchange reserve portfolios are adversely affected by external debt stock, and these effects are statistically significant. Nigeria’s fiscal management should use a safety margin while borrowing abroad to prevent the concurrent external debt servicing from further depleting the nation’s foreign exchange reserves.

On the other hand, the influence that foreign reserves have on the value of the naira is somewhat dependent on the ability of the CBN to rapidly and smoothly implement its foreign exchange strategy, including fiscal and monetary policy measures.

Here, the CBN uses its policies to regulate the country’s economy and prevent its currency from further depletion.