The success of every government depends on income from various sources, and the Nigerian government is no exception. Government revenue, often known as national revenue, is money obtained by a government from taxes and non-tax sources to fund government spending.

Revenues are all monetary inflows into the national government treasury that are collected to finance government expenditures. You cannot fully talk about revenue without relating it to expenditure.

Government expenditure refers to money spent by the government on products and services such as education, healthcare, social protection, and defense. Government revenue and spending are components of the budget and essential fiscal policy tools.

Revenue collection is the most fundamental task of a government because revenue is required for the operation of a government and the enforcement of its laws. Taxes are typically expected to be a significant source of domestic revenue for the Nigerian government. Still, various issues have directly and indirectly impacted taxation, including corruption, theft, inadequate funding, mismanagement of finances, and poor leadership.

However, taxes have recently given the government a good source of income. For instance, it was discovered that the income from business taxes was the reason for the revenue’s sharp increase from N415.7 billion in April to N462.4 billion naira ($1.43 billion) in May 2017.

SOURCES OF GOVERNMENT REVENUE

The government can generate revenue from a variety of sources. The most popular sources of government revenue have changed over time and place. Overall, government revenue can be separated into two categories: oil revenue and non-oil revenue, which are noted below:

1. Oil Revenue

Oil revenue includes earnings from crude oil sales, petroleum profit tax, pipeline licenses, and other fees, rentals, and royalties. Since the 1970s, oil has been the primary source of government revenue, accounting for more than 70% of all federally collected revenue.

2. Non-oil Revenue

Includes all forms of taxation (direct and indirect), borrowing (internal and external), fines and penalties, fees, gifts, and grants.

NON-OIL REVENUES:

Below are examples of non-oil revenues generated by the government:

1. Taxation:

A tax is a compulsory financial contribution made by each eligible citizen towards the expenditure of the government. Taxation is one of the fundamental means of government revenue. It increases the government’s revenue, which funds government spending. We have two main types of taxes, which are direct and indirect.

i. Direct Tax

Direct taxes are taxes filed and paid directly by the taxpayer to the government. When it comes to direct taxes, such as the personal income tax, tax rates often rise as the taxpayer’s ability to pay rises, resulting in what is known as a progressive tax.

ii. Indirect Tax

These are indirect taxes levied on consumer items. Indirect taxes include, among other things, customs and excise taxes, sales taxes, etc. In contrast, to direct taxes levied on specific individuals, indirect taxes are imposed on goods and services and paid for by the retailer or manufacturer, which are subsequently passed on to the final consumers through an increase in the prices of goods and services.

2. Government Borrowing

The government’s spending on the economy is primarily funded by oil and non-oil revenues. When revenue is insufficient to cover expenditures, the government must borrow. Borrowing can be short-term or long-term, involving the sale of government bonds or bills. To help raise short-term cash, Treasury bills are also issued into the money markets.

Types of Government Borrowings

The government can borrow in two distinct ways, such as:

i. Internal Borrowing

When a government borrows money from its citizens through the sale of bonds or long-term credit instruments, this is considered an internal debt and part of a country’s national debt.

ii. External Borrowing

The portion of a country’s debt borrowed from foreign lenders, such as commercial banks, governments, or international financial institutions, is known as external debt. These loans, including interest, must typically be repaid in the currency in which they were made.

3. Fines and Penalties

These are charges imposed on individuals as punishment for breaking the law. The aim is not to collect money from the general public but to force them to obey the country’s laws and order.

i. Fees:

These are the funds received by the government in exchange for its services. These could include things like public schools, insurance, and so on.

ii. Gifts and grants:

Gifts are voluntary contributions from private individuals or non-government donors to a government fund for specific reasons, such as relief or defense during a war or emergency. However, this source only accounts for a minor fraction of government revenue.

Government Expenditure/Spending

Government expenditure refers to money spent by the government on products and services such as education, healthcare, social protection, and defense. In national income accounting, when the government acquires goods and services for current use to directly satisfy the community’s individual or collective needs and requirements, this is classified as government final consumption spending.

Government investment occurs when the government acquires goods and services for future use. This includes public consumption, investment, and transfer payments such as income transfers.

Government spending enables it to produce or purchase goods and services required to meet social and economic objectives. The role and size of governments worldwide have changed drastically over the years.

Government spending increased exponentially in the twentieth century as governments worldwide began to spend more money on education, healthcare, and social protection. Presently, governments in developed countries spend more as a percentage of GDP than governments in developing countries.

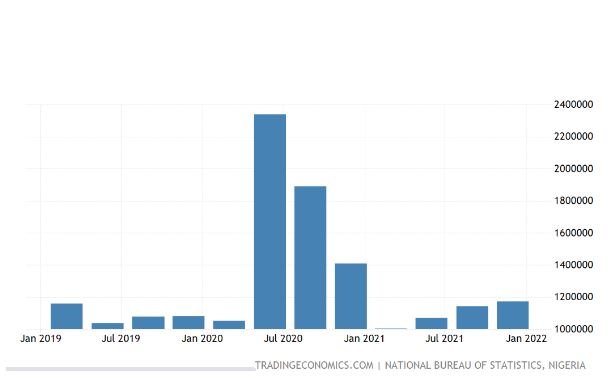

Graph showing govt. expenditure for the past 3yrs

According to the National Bureau of Statistics (NBS) as seen on the graphic illustration above, Nigerian government spending increased to 1,173,404.20 NGN million in the fourth quarter of 2021, up from 1,142,917.52 NGN million in the third quarter.

Government spending is a significant component of GDP and refers to public expenditure on goods and services. Setting budget targets, adjusting taxation, increasing public expenditure, and public works are all very effective tools for influencing economic growth.

The following are some essential factors that influence how much the government spends:

i. The Population of the Country:

Government spending will be higher in a more populous nation than in a small nation. The population makeup of a nation can also affect government spending. For instance, an aging population suggests that more people rely on the government’s paid pensions. Additionally, the government funds more healthcare services for older people.

ii. Fiscal Policy Actions:

Some economic issues can be addressed by governments using fiscal policy measures.

The government may adopt an expansionary fiscal policy during a recession. This would make it possible to increase government spending, which would increase overall demand and close the output gap. Government spending during these times is typically higher than during economic contraction.

Governments frequently use fiscal policy to reduce poverty levels. A country’s poverty can be addressed by: Increased government spending on transfers, giving away goods and services for free, and progressive taxation.

iii. Income Redistribution Policy Measures:

Governments may also enact several policies to promote income redistribution and equality. To redistribute income in society, the government may spend more on welfare benefits.

REASONS FOR GOVERNMENT EXPENDITURE

To improve the supply-side of the macroeconomy, the government spends money for various reasons: In Nigeria, for some years now, the total amount of money that the federal government spends has been more significant than the amount of money generated from taxes.

In all this, the government must spend a considerable amount of the country’s budget on providing basic needs for its citizens. Below are various reasons why governments spend on the economy.

1. Increasing Transfer Payment Spending:

Spending on disability support, state pensions, and unemployment insurance benefits aids people who are unable to work or obtain employment. This kind of income redistribution can potentially lessen the nation’s extreme poverty. A payment that receives neither commodities nor services in exchange is referred to as a transfer payment.

2. Provision of Public Goods and Services:

In most nations, public services like healthcare and education are free. This makes them available to everyone, especially those who might not have been able to access them otherwise.

By giving these services away without charge, poverty’s effects are lessened. In this approach, the government contributes to the human capital of the economy without explicitly doing so, which has the potential to boost economic output.

The government also provides products and services that the private sector does not provide, such as defense, roads, and bridges, welfare payments, and benefits such as disability compensation.

3. Progressive Taxation:

This type of taxation enables income redistribution in society by eliminating economic disparity. Since high-income earners pay progressively more taxes than low-income earners, the government may try to lower poverty levels by trying to narrow the gap between the two income groups. The government can pay for welfare benefits with the tax money it receives.

4. Training of workers:

The government strengthens the macroeconomy’s supply side, such as expenditure on education and training to increase worker productivity. Investment in capital, technological advancements, continuous human capital growth, and education are the primary factors influencing labor productivity.

Both private industry and the public sector can raise workers’ overall labor productivity by directly investing in or indirectly generating incentives for technological advancements, human capital, or physical capital.

5. Provision of Subsidies:

The government offers subsidies to industries that may require financial assistance for operation or expansion. Considering that the private sector cannot meet such financial obligations, the public sector plays a critical role in providing vital assistance. For example, transport infrastructural projects do not attract private funding unless the government invests in the business.

6. Negative Externalities:

The government lessens the adverse effects of externalities, such as pollution, oil spillage, and widgets from industries or commercial activities. Keep in mind that these pollute the environment during production. Society, rather than the factory, shares the expense of the pollution.

Two (2) Types of Government Expenditures

Below are the two types of government expenditures:

1. Recurrent Expenditures:

These are expenditures on products and services that are repeated regularly. These expenditures do not lead to the production or acquisition of fixed assets (new or second-hand). They are composed of expenditures on wages, salaries, and bonuses, as well as consumption of goods and services and depreciation of fixed assets.

2. Capital Expenditures:

Capital expenditures are long-term investments, and it is expected that the assets purchased will have a usable life of at least one year following their purchase. Acquiring real estate, machinery, tools, land, computers, furnishings, and software are all examples of expenditures that fall under this category.

The main distinction is that capital expenditure is a one-time financial expense that is not recurring and affects a long-term asset that cannot be deducted in full in the year it was purchased.

GOVERNMENT BUDGET

We can not talk about government revenue and expenditure without mentioning the government budget.

A government budget is a document that outlines the expected income and expenditures for a specific fiscal year. Government spending plans frequently need legislative approval and are vulnerable to political pressure from interest groups competing for funding.

We have three types of budgets: deficit, surplus, and balanced;

- A budget deficit indicates that government revenues are less than government expenditures. Some economic problems with a deficit budget are demand-pull inflation, an increase in public sector debt, debt interest payments, and higher interest rates. Fiscal rules can be used by governments to avoid overspending.

- A budget surplus indicates that government revenues exceed government spending. High taxation, increased household debt, and lower economic growth are all problems associated with a budget surplus.

- A balanced budget indicates that the government’s anticipated revenues and expenditures are equal.

Every national government earns money (via taxation and other means) and spends it on public services. The management of these sources of revenue and expenditure can result in budget deficits and surpluses in a given period. There are numerous possible outcomes if these accumulate over time.

Maintaining a budget deficit has a variety of effects on the overall activity of the macroeconomy. To begin, additional borrowing increases the debt held by the public sector. If the government continues to run large deficits in its budget, it will be forced to increase the amount it borrows to continue funding its operations. This adds to the already considerable burden of the nation’s mounting debt.

Furthermore, increased borrowing leads to increased debt interest payments. This is the cost of servicing the national debt, which must be paid regularly. Increased interest rates can deter investment and cause the national currency to appreciate (rise in value). This is problematic because it may result in less competitive exports, negatively impacting the country’s balance of payments.