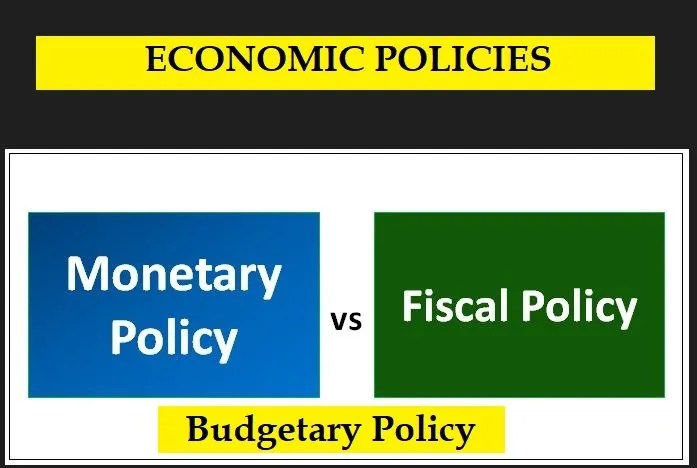

Fiscal and monetary policy are two powerful budgetary policy tools made by the constituted authorities in the government and the Federal Reserve use to steer a country’s economy in the right direction.

Typically, the overarching goal of both monetary and fiscal policy is to create an economic environment with stable and positive growth and low inflation. The goal, crucially, is to steer the underlying economy away from economic booms that may be followed by extended periods of low or negative growth and high unemployment. In such a stable economic environment, households can feel confident in their consumption and saving decisions, while corporations can concentrate on their investment decisions, making regular coupon payments to bondholders and profits for their shareholders.

The rest of this article provides a detailed understanding of fiscal, monetary policy and budgetary policy as well as their types and examples.

What is Budgetary Policy?

Budgetary policy refers to the use of government spending and taxation to influence economic growth and development. In Nigeria, the federal government is responsible for setting the national budget, which outlines the government’s spending priorities for the year.

The budgetary policy is designed to achieve various macroeconomic objectives, including:

- Economic growth: The government can increase its spending on infrastructure and other development projects to stimulate economic growth and create jobs.

- Inflation control: The government can adjust taxes and spending to reduce inflation by reducing demand in the economy.

- Fiscal discipline: The government can use budgetary policy to ensure fiscal discipline and avoid excessive borrowing and debt accumulation.

- Redistribution of income: The government can use taxation and spending policies to redistribute income and reduce inequality in the economy.

The federal government sets its annual budget based on projected revenues from taxes and other sources and allocates spending to various sectors and programs. The budget is usually presented to the National Assembly for approval, and any adjustments made by the legislature are sent back to the executive for assent.

Once the budget is approved, the government implements its spending plans and adjusts taxes and other fiscal policies as needed to achieve its macroeconomic objectives. The effectiveness of budgetary policy in achieving these objectives depends on a range of factors, including the size of the budget, the efficiency of government spending, and the responsiveness of the economy to fiscal stimuli.

2 Types of Budgetary Policies

There are two main types of budgetary policies that a government can use to influence the economy:

1. Expansionary Budgetary Policy:

This policy involves increasing government spending and/or reducing taxes to stimulate economic growth and create jobs. Expansionary budgetary policy is typically used during periods of economic recession or slow growth, when there is a need to boost aggregate demand in the economy. By increasing government spending or reducing taxes, the policy can increase disposable income, which can lead to increased consumption and investment, and ultimately, increased economic growth.

2. Contractionary Budgetary Policy:

This policy involves reducing government spending and/or increasing taxes to slow down the economy and control inflation. Contractionary budgetary policy is typically used during periods of high inflation or overheating in the economy, when there is a need to reduce aggregate demand to prevent prices from rising too quickly. By reducing government spending or increasing taxes, the policy can reduce disposable income, which can lead to reduced consumption and investment, and ultimately, decreased economic growth.

Both expansionary and contractionary budgetary policies have their advantages and disadvantages, and the appropriate policy to use depends on the prevailing economic conditions and the specific objectives of the government. In general, expansionary budgetary policies tend to be popular with citizens, as they lead to increased economic activity and job creation. However, they can also lead to inflation and a rise in public debt. Conversely, contractionary budgetary policies tend to be unpopular, as they can lead to a slowdown in economic activity and job losses, but they can also help to control inflation and reduce public debt.

What is Fiscal Policy?

Fiscal policy refers to the use of government spending and taxation to influence the economy. It is one of the primary tools used by governments to manage economic growth and development. Fiscal policy is typically used in conjunction with monetary policy, which is the use of central bank tools to influence the supply of money and credit in the economy.

Governments use fiscal policy as a tool achieve the allocative function of a budget policy and to manage the economy as a whole. Fiscal policy is significant because it influences how much money consumers take home. Households cannot spend as much as they used to due to lower income levels, affecting demand and thus jobs in the broader economy.

The effectiveness of fiscal policy in achieving its objectives depends on various factors, such as the size of the budget, the efficiency of government spending, and the responsiveness of the economy to fiscal stimuli. In addition, the impact of fiscal policy on the economy can be affected by other factors, such as monetary policy, external shocks, and global economic conditions.

Fiscal policy can be used to achieve a range of macroeconomic objectives, which includes:

- Economic growth: The government can increase its spending on infrastructure and other development projects to stimulate economic growth and create jobs.

- Inflation control: The government can adjust taxes and spending to reduce inflation by reducing demand in the economy.

- Fiscal discipline: The government can use fiscal policy to ensure fiscal discipline and avoid excessive borrowing and debt accumulation.

- Redistribution of income: The government can use taxation and spending policies to redistribute income and reduce inequality in the economy.

There are two main components of fiscal policy: government spending and taxation. The government can use these tools to influence the overall level of demand in the economy. If the government increases its spending or reduces taxes, it increases demand, which can lead to economic growth. Conversely, if the government reduces its spending or increases taxes, it reduces demand, which can slow down economic growth.

Types of Fiscal Policy

There are two main types of fiscal policy that a government can use to influence the economy:

- Expansionary Fiscal Policy: This policy involves increasing government spending and/or reducing taxes to stimulate economic growth and create jobs. Expansionary fiscal policy is typically used during periods of economic recession or slow growth, when there is a need to boost aggregate demand in the economy. By increasing government spending or reducing taxes, the policy can increase disposable income, which can lead to increased consumption and investment, and ultimately, increased economic growth.

- Contractionary Fiscal Policy: This policy involves reducing government spending and/or increasing taxes to slow down the economy and control inflation. Contractionary fiscal policy is typically used during periods of high inflation or overheating in the economy, when there is a need to reduce aggregate demand to prevent prices from rising too quickly. By reducing government spending or increasing taxes, the policy can reduce disposable income, which can lead to reduced consumption and investment, and ultimately, decreased economic growth.

Both expansionary and contractionary fiscal policies have their advantages and disadvantages, and the appropriate policy to use depends on the prevailing economic conditions and the specific objectives of the government. In general, expansionary fiscal policies tend to be popular with citizens, as they lead to increased economic activity and job creation. However, they can also lead to inflation and a rise in public debt. Conversely, contractionary fiscal policies tend to be unpopular, as they can lead to a slowdown in economic activity and job losses, but they can also help to control inflation and reduce public debt.

In addition to the above 2 types of fiscal policy, governments can also use other fiscal tools to achieve their economic objectives. For example, they can use targeted tax credits or deductions to incentivize specific activities or industries, or they can use targeted spending programs to support particular groups or regions. These targeted fiscal policies can be effective in achieving specific objectives but can also be more challenging to implement and may not have as broad an impact on the overall economy.

What Is Monetary Policy?

Nigeria’s monetary policy is overseen and implemented by the Central Bank of Nigeria (CBN), which is the country’s primary monetary authority. The CBN’s primary objective is to maintain price stability and promote economic growth in Nigeria. The central bank may raise borrowing rates to discourage spending or lower borrowing rates in order to encourage more borrowing and spending. Its primary weapon is the nation’s money. The central bank determines the interest rates at which it lends money to the country’s banks. When the Federal Reserve raises or lowers interest rates, all financial institutions adjust the rates they charge all of their customers, from large corporations borrowing for large projects to home buyers applying for mortgages.

What Goes Into Policy Decisions

Monetary policy is developed using data from a variety of sources. The monetary authority may examine macroeconomic figures such as GDP and inflation, as well as industry and sector-specific growth rates and associated figures. Geopolitical developments are also being closely monitored. Oil embargoes and the imposition (or removal) of trade tariffs are two examples of actions that can have far-reaching consequences.

Concerns from groups representing specific industries and businesses, survey results from private organizations, and input from other government agencies may also be considered by the central bank.

Monetary Policy Tools

To achieve its objectives, the CBN employs various monetary policy tools, including:

- Interest rates

- Reserve requirements

- Open market operations

- Foreign exchange management

In recent years, the CBN has also implemented various unconventional monetary policy measures, such as direct lending to targeted sectors of the economy and regulatory measures aimed at promoting financial inclusion and stability.

1. Interest rates

Interest rates are the cost of borrowing money, typically expressed as a percentage of the total amount borrowed. In Nigeria, the Central Bank of Nigeria (CBN) is responsible for setting interest rates. The CBN uses interest rates as one of its primary tools to achieve its monetary policy objectives, such as controlling inflation, promoting economic growth, and stabilizing the exchange rate.

When the CBN raises interest rates, it becomes more expensive for businesses and individuals to borrow money, which can help to reduce spending and curb inflation. Conversely, when the CBN lowers interest rates, it becomes cheaper for businesses and individuals to borrow money, which can encourage spending and stimulate economic growth.

In Nigeria, the CBN sets various interest rates, including the Monetary Policy Rate (MPR), the discount rate, and the prime lending rate. The MPR is the benchmark interest rate used to guide other interest rates in the economy. The discount rate is the interest rate at which banks can borrow from the CBN, while the prime lending rate is the interest rate that commercial banks charge their most creditworthy customers.

2. Reserve requirements

Reserve requirements refer to the percentage of a bank’s total deposits that it is required to hold in reserve, either in the form of cash or with the Central Bank of Nigeria (CBN). The reserve requirement is set by the CBN as part of its monetary policy framework, and it serves as a tool to influence the amount of money that banks can lend out to their customers.

When the CBN increases the reserve requirement, it reduces the amount of money that banks have available to lend out, which can help to control inflation by reducing the amount of money in circulation. Conversely, when the CBN lowers the reserve requirement, it increases the amount of money that banks can lend out, which can stimulate economic growth by increasing the amount of money in circulation.

The reserve requirement is typically expressed as a percentage of a bank’s total deposits, and it varies depending on the size and type of bank. For instance, the reserve requirement for commercial banks is currently set at 27.5% of their total deposits, while the reserve requirement for microfinance banks is 3%. Banks that fail to meet the reserve requirement are subject to penalties and fines.

3. Open market operations

Open market operations (OMO) refer to the buying and selling of government securities by the Central Bank of Nigeria (CBN) in the open market. The CBN uses OMO as a monetary policy tool to influence the money supply in the economy, which in turn affects inflation and interest rates.

When the CBN buys government securities in the open market, it injects money into the economy, which can increase the money supply and lower interest rates. Conversely, when the CBN sells government securities in the open market, it takes money out of the economy, which can reduce the money supply and raise interest rates.

The CBN typically conducts OMO through auctions, where it offers to buy or sell government securities to banks and other financial institutions. The price and quantity of government securities offered by the CBN are determined by market forces, such as supply and demand, and the CBN uses the results of the auction to adjust the money supply and interest rates as needed to achieve its monetary policy objectives.

OMO is considered an important tool in the CBN’s monetary policy toolkit, as it allows the bank to directly influence the money supply in the economy without the need for legislative action or government approval.

4. Foreign exchange management

Foreign exchange management refers to the process by which the Central Bank of Nigeria (CBN) manages Nigeria’s foreign exchange reserves and intervenes in the foreign exchange market to stabilize the exchange rate and prevent excessive fluctuations.

The CBN’s foreign exchange management policy is designed to promote a stable and competitive exchange rate, which is seen as critical for the country’s economic growth and development. To achieve this, the CBN uses various tools and measures, including:

- Foreign exchange reserves: The CBN maintains foreign exchange reserves, which are used to manage the exchange rate and ensure that there is adequate foreign currency to meet Nigeria’s import needs and external obligations.

- Exchange rate interventions: The CBN intervenes in the foreign exchange market by buying and selling foreign currency to influence the exchange rate. For instance, when the exchange rate is depreciating too rapidly, the CBN may sell foreign currency to support the naira and prevent excessive depreciation.

- Foreign exchange restrictions: The CBN may also impose restrictions on the use of foreign currency in certain transactions, such as imports or transfers of funds abroad. These restrictions are intended to conserve foreign exchange reserves and encourage the use of local currency.

- Exchange rate policies: The CBN also sets exchange rate policies, such as the official exchange rate and the interbank exchange rate. These policies can influence the exchange rate by creating incentives for foreign exchange inflows and outflows.

The CBN’s foreign exchange management policy plays a critical role in maintaining Nigeria’s external sector stability and supporting economic growth and development.