First bank is known as one of the oldest banks in Nigeria, which automatically means that First Bank, has a lot of old customers at least before some new banks came into the picture. FBN works as a parent business in Nigeria, with subsidiaries in the Republic of Congo, Gambia, Ghana, Guinea, Senegal, and Sierra Leone. In this post I will be harping on all you need to know about First Bank USSD Code for obtaining your BVN, blocking of your account in case of cyber fraud or emergency purposes and how to access First bank loan using their USSD code or FirstMobile App.

Before delving to the crux of this article, it would be worthwhile shedding more light on FBN’s achievements on the area of cashless policy introduced by the Central Bank of Nigeria.

First Bank has been quick to promote Africa’s digital economy, issuing over 10 million cards, making it the first bank in Nigeria to do so. As a result of its financial inclusiveness and cashless activity push has resulted in over 228 million customers on its USSD banking service via the nationally recognized *894# banking service and over 3.4 million users on its First mobile platform. The Bank, which has been providing development-oriented services for over 126 years as the region’s leading supplier of financial inclusion services, provides a complete range of retail and corporate financial services to over 17 million customers through more than 44,000 business locations.

BVN for First Bank

Are you one of those, who has been struggling to register or check their BVN (Bank Verification Code) on First bank? Well, you do not need to be overly stressed about any of it, I will be explaining how to register as well as check your BVN with ease with just the First bank code. The best part of it is that you don’t need internet on your phone to do that, all you need is a mobile phone. Let’s start by explaining what BVN is.

Bank Verification Code/Number (BVN)

Nigeria’s government is working hard to implement more techniques and methods to combat any type of criminal activities in the nation, and one of the most effective methods is through BVN. BVN stands for Bank Verification Number and it is a biometric identification system developed by the Central Bank of Nigeria in collaboration with the Nigerian Interbank Settlement System (NIBSS) to minimize illicit financial activities.

The BVN code is an 11-digit number that serves as your universal ID in all Nigerian banks.

It is just as vital as having a phone number for filling out NIMC forms and other relevant forms both within and outside the country.

First Bank BVN Number

You may now verify your BVN number code on your mobile phone to find out your First Bank Verification Number (BVN) due to the simple ways.

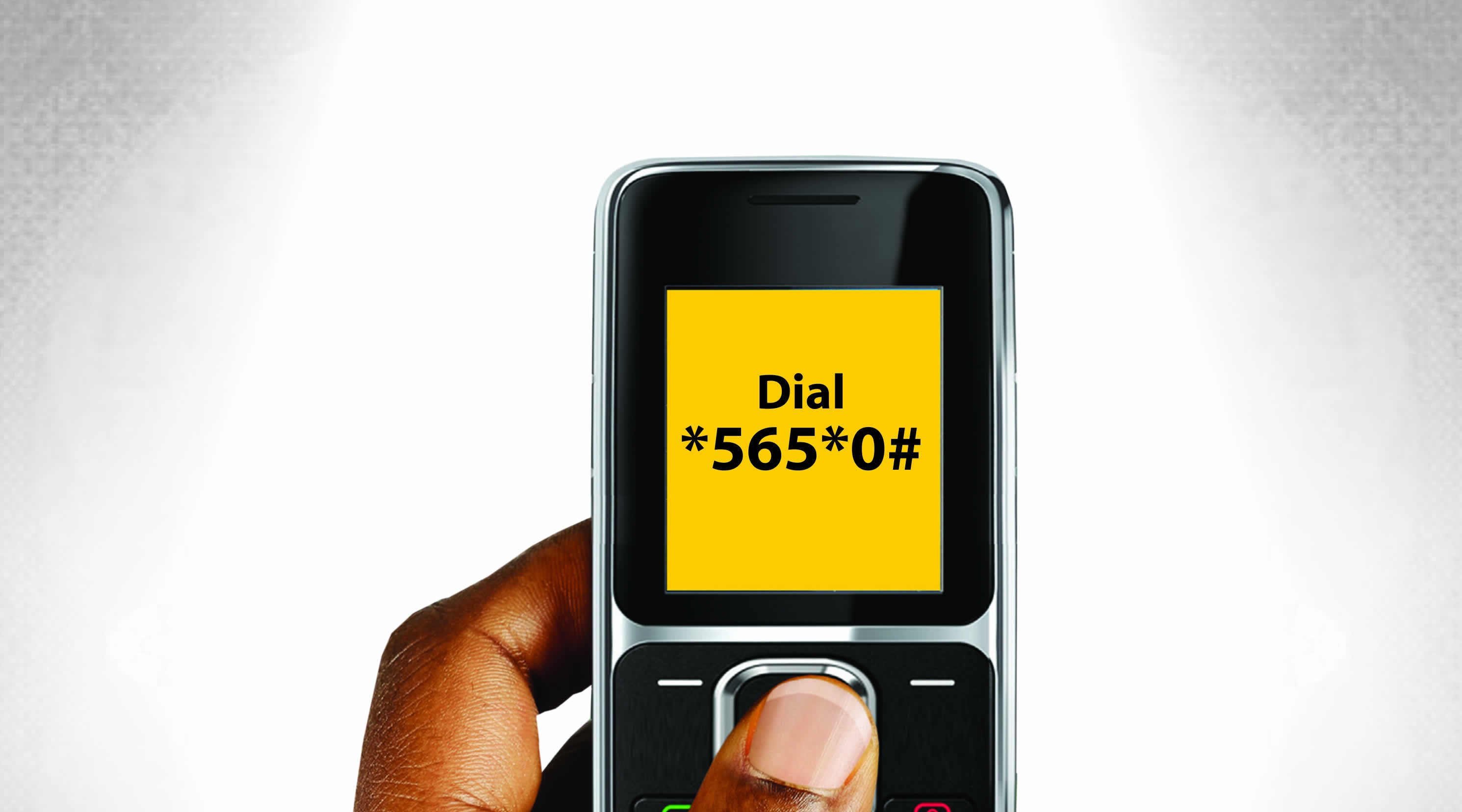

To check your Bank Verification Number, call 5650#. (BVN).

You do not need to connect to the internet or use a high-end smartphone to check your BVN code.

You may use this code to learn how to verify your BVN code number on any SIM card.

People who have been asking questions regarding BVN, I think, now have an explanation. Codes for different networks;

Dial 5650# for MTN.

Dial 5650# for Airtel.

Dial 5650# for 9mobile (Etisalat).

Dial 5650# to reach Glo.

To obtain your BVN number with any Nigerian network, you must pay a fee, which is luckily not excessive. In Nigeria, checking your BVN code number costs only N10.

This is why getting your BVN is important in Nigeria, for those who may be asking;

Why Should You Get a BVN?

Because we are devoted to maintaining the smooth operation of all your financial operations, we strongly advise you to obtain your BV for the following reasons;

Security – Your BVN protects your account from unwanted access.

When you transact using your BVN, you will receive expedited services at First Bank locations.

Ease of Tracking – Your BVN lets you to trace all of your transactions in any bank. This explanation would not be complete without showing you how to register for your BVN. Let’s take a look that, below.

How to Sign Up For Your BVN at First Bank

To register, you must do the following;

Fill out and return the BVN enrollment form. The form is available at any First Bank branch or may be downloaded online.

At the time of submission, you must submit a valid form of identification, which can be any of the following:

International Passport

Driver’s License

Voter Registration Card

Or National ID Card

Make sure to get the following requirements ready before going for your BVN, as this will help make the process go smoothly and without stress.

Also, in this article, I will also be showing you ways to block your debit card as well as unblock it. Read below.

How to Block & Unblock your First Bank Account And Debit Card In a few Seconds

Here’s a step-by-step guide to blocking and unblocking your First Bank account and debit card in Nigeria.

Examine it out!

Because of living conditions, it is quite simple to misplace one’s ATM card or accidentally give one’s bank account data to fraudsters. I’ve heard of folks who misplaced their debit cards for whatever reason, just to have their whole life savings taken in less than 24 hours. Though stories like these make one wonder about the sort of hearts some people have, such incidents may be prevented. Without a shadow of a doubt, after you’ve lost your debit card, the safest approach to protect your bank account and money is to disable the card.

Are you looking for a way to ban your First Bank account or ATM card online?

This page includes the First Bank of Nigeria account banning code as well as numerous alternative methods for rendering your lost debit card inoperable for any transaction. Continue reading!

How to Block Your First Bank Account or Misplaced Card

Debit Card And First Bank Account Block Code

Dial *894# and follow the instructions on your screen to ban your First Bank of Nigeria account or ATM card. The card will be banned within a few minutes and cannot be used for cash withdrawals or purchase of goods and services until you visit your bank to unlock it.

This is unquestionably the quickest approach to prevent opportunists (fraudsters and cyber thieves) from using your stolen debit cards for fraudulent online and offline purchases.

Using the Facebook Mobile App

This is also a pretty simple approach to disable your debit card. Simply log in to your First Bank mobile app and follow the instructions to ban your ATM card. Wait a few seconds after clicking on it. Your misplaced ATM card will cease operating in less than 5 seconds, no matter where it is!

Using SMS

You can also use the bank’s text messaging service to block your First Bank account or ATM card.

You will, however, require at least N4 airtime on your phone to carry out this action. Although this approach is likewise quick, it cannot be compared to the first. Send “BLOCK” in an SMS to 30012 to deactivate your FB debit card or block your account via the bank text message service. Your misplaced ATM card will cease operating in less than 5 seconds, no matter where it is!

A Phone Call to the Customer Service Center

Another excellent technique to prevent your misplaced First Bank of Nigeria debit card from functioning is to contact the bank’s customer service personnel through mobile phone call.

The phone number is 0700-34778-2668228.

When you phone the customer care number for this purpose, you may be asked a series of questions to verify that the card is yours. Once you’ve shown that, the card will be rendered inoperable.

Though this approach is also a viable alternative, it does need a significant quantity of airtime on your line prior to dialing. You should also maintain your bank account information on available in case it is requested.

Next, I will be talking about how to get access to First bank loan, as a First bank customer.

When it comes to loans, you have a number of alternatives, including banks and internet lenders. However, not all loans are alike, and First Bank loans are a cut above the rest. If you need a loan, go to your local First Bank. They provide a wide range of lending choices, from personal loans to home loans, all with extremely competitive interest rates.

First Bank Loans that are Available.

First Bank loans are available in a number of forms, each with attractive rates and terms:

Loans for individuals.

With a personal credit line, you may borrow money right away, or you can leverage the equity in your house to get a home equity loan.

Loans for businesses.

Make use of a credit line, a lump-sum company loan, or a construction loan to finance a business.

Cards with credit.

To perform personal or commercial transactions today then pay for it tomorrow, take advantage of no yearly fees and attractive interest rates.

Mortgages.

A First Bank loan can be used for conventional, government, jumbo, commercial, or professional purposes.

How To Access First Bank Loan (FirstAdvance) Using USSD Code & FirstMobile App

With First Bank, applying for a loan is straightforward. Speak with one of our experts about a business loan during a small company finance consultation.

A mortgage loan application may be completed online, simply contact your local First Bank and chat with one of our representatives about personal loans or credit cards. You can access any of the above listed First bank loans by dialing 89411# and it is also expected that you must have activated First bank mobile bank on your device.

- Start by dialing *894# to get you connected to the First Bank’s code banking, then select 3 or *894*11#

- The next page shows the amount you are eligible to get.

- Next is to input your desired amount and then send

- Your Interest rate, Insurance and Management fees will be displayed next.

- Input your 5 digit password or transactional pin to accept terms and conditions (Always do well to go through them).

- Loan amount will then be sent into your account within minutes of confirmation

- Take note, your account will be debited for Insurance, Interest rate, Management fee and VAT as payment upfront.

- On the expiry of the 30 days, your account will be debited for Principal repayment or your salary, if it is paid

Similarly, you can also use the First Mobile app. To apply for FirstAdvance using the FirstMobile

- Open the menu choices in the upper left-hand corner.

- Choose ‘Loans.’

- Then, choose ‘FirstAdvance.’

- The next menu option displays your qualifying amount as well as the associated price and costs.

- Accept the Terms & Conditions next.

- Next, enter the desired loan amount, which must be less than the qualifying amount.

- Then comes your transaction pin.

- If you are successful, your loan will be transferred to your salary account within minutes.

- As upfront fees and charges, your account is debited for Management fee & VAT, Interest rate, and Insurance.

- On the expiry of the 30 days, your account will be debited for Principal repayment or your salary, if it is paid.

Features of First Advance Loan

Salary accounts must be domiciled with First Bank. Loan amounts of up to 50% of net monthly income are available.

- The tenor is 30 days or until the following pay day.

- N500,000.00 is the maximum single obligor limit.

- Flat interest rate of 2.5 percent with an upfront management charge of 1.0 percent collected

- Credit Life Insurance @ 0.50%.

- First Advance is a more advanced version of Digital SODA.

- The loan can be retrieved up to three times each day, subject to the maximum allowable amount

- First Advance’s Risk Acceptance Criteria are automated.

- Repayment is made as soon as the salary is received, and a lien is put on the underfunded account.

- All costs, including the interest rate, are collected in advance.

In Summary

This article will guide you on what code to use in other to access your BVN, how to register it, as well as the importance. You would also see the step by step guide, on how to block your account, as well as additional information on how to unblock your line and gain access to various types of loans. This article also explains the different types of loans you can access as a First bank customer and their different purposes. For all First bank customers, this article is a complete package for whatever information you are looking for, as regards to the subject matter.